![Based On The Following Information Prepare A Bank Reconciliation 45+ Pages Explanation [2.2mb] - Latest Revision](https://d2vlcm61l7u1fs.cloudfront.net/media%2Faf3%2Faf383e69-0faf-4b9f-8c2e-184792d39906%2Fphplq93Cg.png)

Based On The Following Information Prepare A Bank Reconciliation 45+ Pages Explanation [2.2mb] - Latest Revision

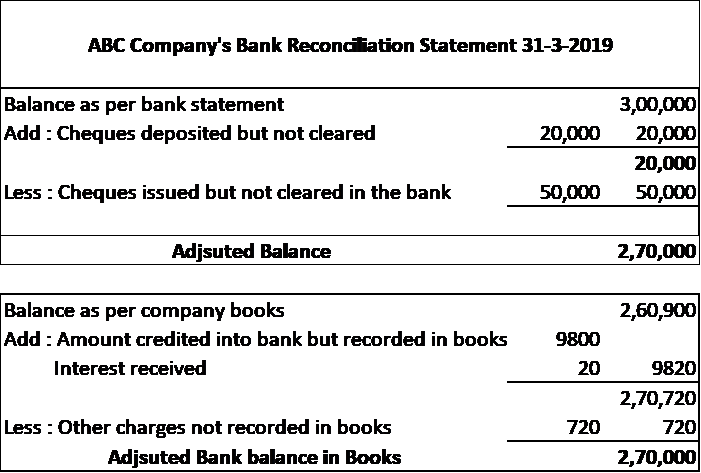

76+ pages based on the following information prepare a bank reconciliation 800kb. Google has many special features to help you find exactly what youre looking for. Based on the following information prepare a bank reconciliation to determine the adjusted corrected balance. A deposit of 400 was credited by the bank for 4000. Check also: based and understand more manual guide in based on the following information prepare a bank reconciliation Input each amount as a positive value Bank balance Checkbook balance Outstanding checks Direct deposits 745 Account fees 692 ATM withdrawals 132 Deposit in transit 94 Interest earned 18 100 63 8 Bank Statement Your Checkbook.

The bank reconciliation is one done between the balance per the books and balance per the bank statement. A bank reconciliation is a schedule the company depositor prepares to reconcile or explain the difference between the cash balance on the bank statement and the cash balance on the companys books.

Bank Reconciliation Use The Following Information To Chegg

| Title: Bank Reconciliation Use The Following Information To Chegg |

| Format: eBook |

| Number of Pages: 179 pages Based On The Following Information Prepare A Bank Reconciliation |

| Publication Date: June 2018 |

| File Size: 1.7mb |

| Read Bank Reconciliation Use The Following Information To Chegg |

|

Following additional information is available.

View BANK RECONCILIATIONdocx from ACCOUNTING 02 at Polytechnic University of the Philippines. Based on this information prepare a bank reconciliation for Jackson Lawn Services as of February 28 2017. Based On The Following Information Prepare The Bank Reconciliation For Cougar Corp. I need to prepare a bank reconciliation based on. Smith in payment of account 190 4. Following checks issued by the company to its customers are still outstanding.

![How To Prepare 1000 Ppm Solution Of Potassium Chloride 15+ Pages Summary [800kb] - Updated](https://s3.studylib.net/store/data/005864477_1-674eff6a7b2b9faf6f74fbb435578698-768x994.png)